This was a week where power plays abroad and policy shocks at home rippled through politics and markets alike.

From Beijing’s military pageantry with Moscow at its side to Washington’s immigration crackdown and renewed pressure on the Fed, the world’s biggest economies showed little interest in subtlety.

In London, political turmoil deepened with a high-profile resignation and hurried reshuffle, while investors on Wall Street weighed a soft US jobs report that sharpened expectations of rate cuts.

Here’s what you need to know.

Trump’s week: Fed pressure intensifies, tech titans at the White House

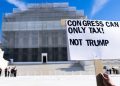

President Donald Trump formally narrowed his shortlist for the next Federal Reserve chair to three names — National Economic Council head Kevin Hassett, former Fed Governor Kevin Warsh and current Governor Christopher Waller — underscoring the administration’s desire for faster easing as growth cools.

In parallel, federal agents detained roughly 475 workers in a single-site immigration raid at Hyundai’s EV battery complex under construction in Georgia — work at the site was paused following the operation.

South Korea protested after officials said more than 300 of those held were its nationals, heightening diplomatic sensitivities around supply chains and foreign direct investment.

Earlier in the week, President Trump hosted a high-stakes dinner in the newly renovated Rose Garden on September 4, bringing together a who’s who of Silicon Valley—Mark Zuckerberg, Tim Cook, Bill Gates, Sam Altman, Sundar Pichai, Satya Nadella, among over two dozen tech leaders.

It was less a social call and more a staged display. Trump went around the table asking CEOs, “How much are you investing in our country?”—and the pledges poured in.

Meta and Apple each committed about $600 billion in US investments through 2028

Xi’s parade with Putin and Kim broadcasts strategic alignment

China marked the WWII victory anniversary with a major military parade in Beijing attended by Russia’s Vladimir Putin and North Korea’s Kim Jong Un — a tableau designed to project cohesion among US rivals amid wars and sanctions.

The optics, sequencing, and state media framing were unambiguous: tighter political theatre, expanding defence ties, and shared grievance narratives.

3) UK shock: Rayner quits; Starmer executes a rapid Cabinet reset

Britain’s Deputy Prime Minister Angela Rayner resigned after an ethics probe concluded she breached the ministerial code over underpaid stamp duty on a recent property purchase.

The exit triggered a quick reshuffle: David Lammy was moved to Deputy Prime Minister (and Justice Secretary), Yvette Cooper shifted to Foreign Secretary, and Shabana Mahmood took the Home Office, among other changes.

The episode is a political blow to Prime Minister Keir Starmer and reopens debates about Labour’s internal balance of power.

Wall Street: choppy finish, mixed week

US equities slipped on Friday, even as the S&P 500 and Nasdaq eked out weekly gains; the Dow finished the week lower.

Into the close, the Dow fell about 0.5%, the S&P 500 0.3%, and the Nasdaq was essentially flat on the day.

For the week: Dow −0.3%, S&P 500 +0.3%, Nasdaq +1.1%. The tape reflected a push-pull between weak macro data and hopes for deeper Fed cuts.

August nonfarm payrolls rose by only 22,000, with prior months revised to show a weaker trend; the unemployment rate ticked up to 4.3%.

The Bureau of Labor Statistics’ release reinforced the rate-cut expectations going into the September Fed meeting.

The post Weekly recap: tech titans woo Trump, Xi’s political theatre, Starmer’s reshuffle appeared first on Invezz