Shares in Orsted sank more than 27% on Monday, nearing an all-time low, after the Danish renewable-energy group scrapped plans to sell a stake in a key US offshore wind project and announced a $9.4 billion rights issue to shore up its finances.

The state-backed company said it would raise gross proceeds of 60 billion Danish kroner through a share offering to existing shareholders, with the Danish government — its majority owner — committing to subscribe for its pro rata share.

The move is aimed at providing the funds needed to continue building its offshore wind portfolio despite significant challenges in the US market.

US market troubles derail sale of Sunrise Wind project

Orsted had planned to sell part of its Sunrise Wind project off the coast of New York to free up capital.

However, recent adverse developments in the US offshore wind sector have made completing the partial divestment on favourable terms impossible, the company said.

This setback means Orsted will have to fully fund the construction of Sunrise Wind itself, creating an additional 40 billion kroner in financing needs.

The project has already been hit by supply chain and construction delays that caused hundreds of millions of dollars in impairments.

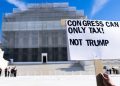

Political headwinds under Trump intensify

The US offshore wind industry is facing a more hostile policy environment following the return of Donald Trump to the White House.

The Trump administration has suspended new federal wind leases, begun phasing out renewable energy tax credits through a new tax-and-spending bill, and imposed tariffs on European steel and aluminium imports — all of which have weighed on project economics.

Orsted Chair Lene Skole said the rights issue was the result of a comprehensive review of options in light of these “unprecedented regulatory developments” in the US.

“The rights issue will strengthen Orsted’s capital structure and provide financial robustness in the years 2025 through 2027, during which we will deliver on our 8.1 gigawatt offshore wind construction portfolio,” she said.

Funding shift to strengthen the balance sheet

The company said proceeds from the rights issue will be used to cover the Sunrise Wind funding gap, strengthen the balance sheet, support flexibility in offshore partnerships and divestments, and boost resources for projects in core European markets and select Asia Pacific regions.

An extraordinary general meeting has been scheduled for September 5 to approve the fundraising.

Orsted is also maintaining its guidance for earnings before interest, taxes, depreciation and amortisation (Ebitda) — excluding impacts from new partnership agreements and cancellation fees — at between 25 billion and 28 billion kroner.

The group has increased its 2025–2027 investment target to 145 billion kroner from 130 billion kroner and expects Ebitda, excluding new partnerships and cancellation fees, to exceed 28 billion kroner in 2026 and 32 billion kroner in 2027.

Second-quarter Ebitda came in at 5.34 billion kroner, beating market expectations of 4.81 billion kroner and up slightly from 5.27 billion kroner a year earlier.

Orsted’s balance sheet is a long-running concern: analysts

Orsted’s balance sheet has been a long-running investor concern, and the scale of the rights issue is likely to be viewed negatively, according to RBC Capital Markets analyst Alexander Wheeler.

Recent headlines have detailed challenges in selling assets in the current market, but Wheeler thinks most focus has been on assets such as the UK’s Hornsea 3 and Changhua 2 in Taiwan.

“Most of the rights issue will be consumed by the additional funding requirements for Sunrise Wind, a project that is already materially squeezed on returns,” he adds.

The post Orsted shares plunge 27% as US wind project sale collapses, $9.4B rights issue announced appeared first on Invezz